The coconut oil market is set to experience a dynamic first half of 2025, shaped by moderate production levels, stable trade patterns, and firming prices influenced by supply-demand dynamics and broader market trends in lauric oils. Key data indicate a market characterized by steady consumption growth and pricing shifts, which reflect the sector’s resilience amid climatic and economic challenges. Global production of coconut oil is expected to stabilize at 3.22 million metric tons (MMT) in 2025, slightly lower than the 3.28 MMT projected for 2024.

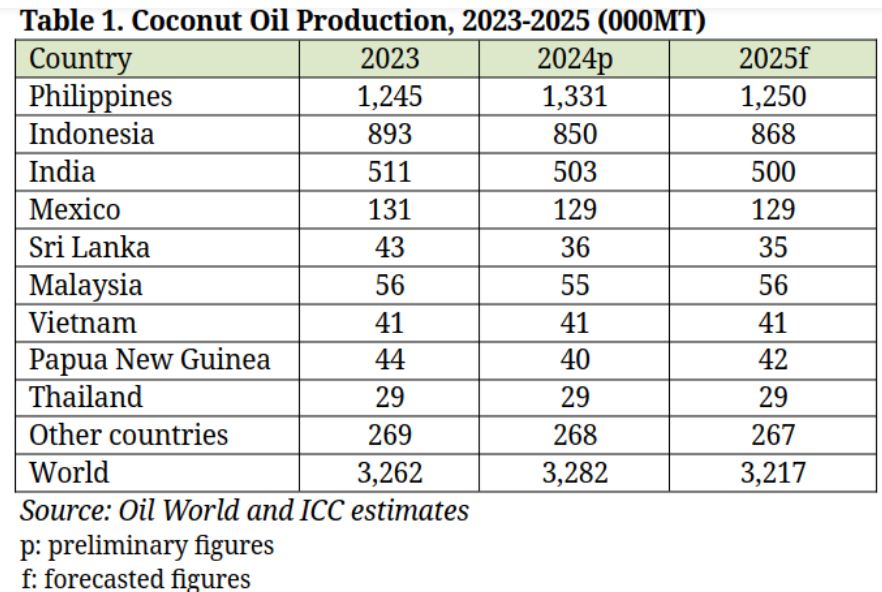

The coconut oil market is set to experience a dynamic first half of 2025, shaped by moderate production levels, stable trade patterns, and firming prices influenced by supply-demand dynamics and broader market trends in lauric oils. Key data indicate a market characterized by steady consumption growth and pricing shifts, which reflect the sector’s resilience amid climatic and economic challenges. Global production of coconut oil is expected to stabilize at 3.22 million metric tons (MMT) in 2025, slightly lower than the 3.28 MMT projected for 2024. This modest decline stems from the lingering effects of climate variability, including unpredictable rainfall patterns and the aftermath of adverse weather events in key producing regions. The Philippines, the largest producer, is forecasted to reduce output from 1.33 MMT in 2024 to 1.25 MMT in 2025, while Indonesia and India are expected to see marginal changes, with outputs of 0.87 MMT and 0.50 MMT, respectively. The combined contributions from smaller producers are unlikely to offset the decline in major producing countries, leading to constrained supply in the global market.

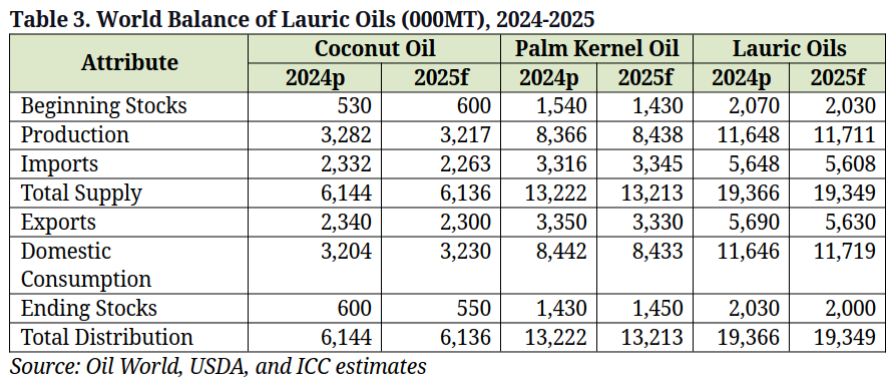

Demand for coconut oil remains robust across food, industrial, and specialty sectors. Consumption is forecasted to rise slightly from 3.20 MMT in 2024 to 3.23 MMT in 2025, reflecting steady demand in premium markets such as the United States and the European Union. These regions continue to prioritize sustainably sourced and high-quality oils, driven by health-conscious consumer preferences and the expanding use of coconut oil in plant-based and natural products. Emerging economies, particularly China, are also expected to increase their import volumes, further supporting global demand. However, the competitiveness of palm kernel oil, a key substitute, will play a crucial role in influencing trade and pricing patterns for coconut oil.

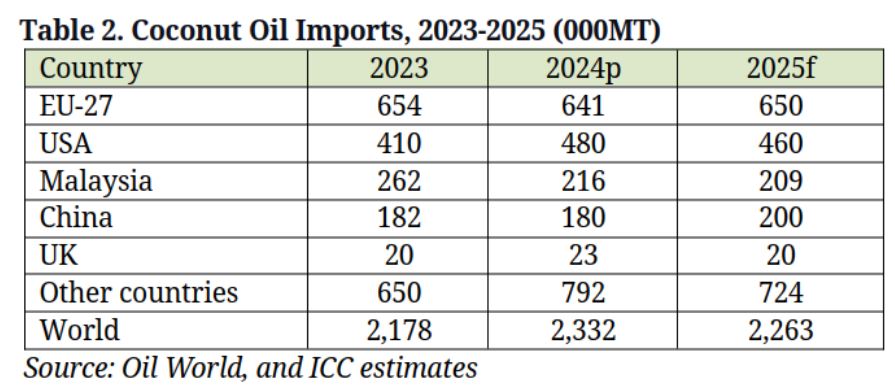

Trade flows are expected to remain stable in the first half of 2025, with the EU and the United States leading import activity. EU imports are projected to reach approximately 650,000 metric tons (MT) for the year, with a consistent flow in the first half, while U.S. imports are expected to average around 460,000 MT annually. China’s import demand is anticipated to grow, with total imports for 2025 likely exceeding 200,000 MT, reflecting its increasing reliance on coconut oil for both food and industrial applications. However, imports from Malaysia and other smaller markets are expected to continue declining, emphasizing a shift in trade dynamics favoring large and emerging economies.

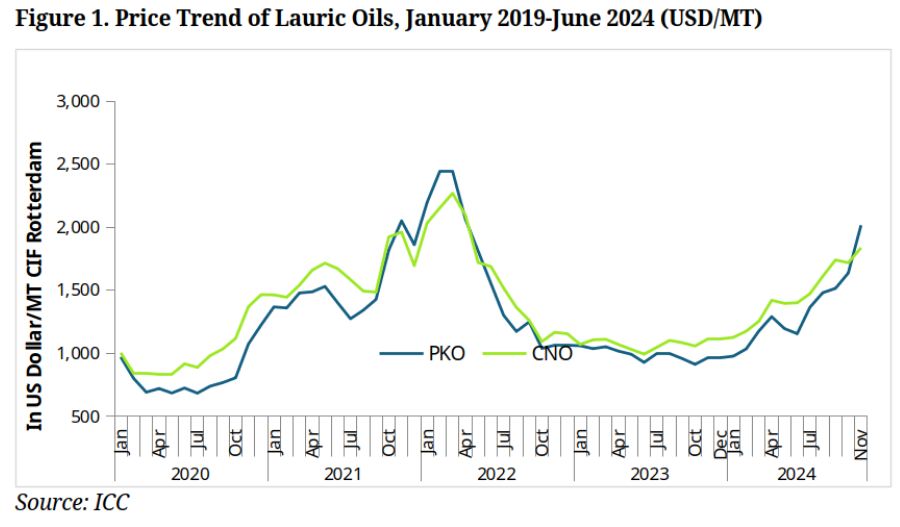

The price outlook for the first half of 2025 reflects tight supply and resilient demand. Coconut oil prices are estimated to range between $1,900 and $2,050 per metric ton, representing a significant premium over historical averages. This price strength is driven by reduced beginning stocks, forecasted at 550,000 MT by mid-2025, and constrained production growth. Meanwhile, palm kernel oil, which competes closely with coconut oil in industrial applications, is projected to trade between $1,850 and $1,950 per metric ton. The narrowing price gap between these two lauric oils reflects increased competition and the substitutability of palm kernel oil in cost-sensitive industries.

The firming of coconut oil prices in early 2025 is attributable to tightening global supplies and steady demand growth. The carryover stock from 2024, projected at 600,000 MT, is expected to decline to 550,000 MT by mid-2025, indicating reduced availability in the market. This drawdown in stocks, coupled with modest production levels, is likely to support higher price levels during the first half of the year. Palm kernel oil, with slightly stronger production prospects and a beginning stock of 1.43 MMT in 2025, is anticipated to face less upward pressure, although its price trajectory will still reflect broader edible oil market trends.

One of the critical drivers influencing the market outlook is the interplay between supply chain resilience and environmental factors. Coconut oil production continues to face challenges from climate variability, including erratic rainfall and increasing pest pressures, which are particularly acute in smallholder-dominated sectors like those of the Philippines and Indonesia. These disruptions contribute to the uncertainty surrounding production recovery and could exacerbate supply tightness if adverse weather conditions persist. On the demand side, the increasing incorporation of coconut oil into renewable energy applications, such as sustainable aviation fuel (SAF), adds a layer of complexity, as it creates competition between traditional and emerging uses.

Another factor shaping the outlook is the global economic environment, which impacts disposable incomes, purchasing patterns, and trade flows. The continuing emphasis on sustainability in developed markets is expected to underpin demand for certified and responsibly sourced coconut oil, which commands a premium. However, the economic pressures in price-sensitive regions could dampen growth in consumption, as consumers may opt for lower-cost alternatives like palm oil or other vegetable oils.

In conclusion, the first half of 2025 is likely to witness steady demand growth, tight supplies, and firm prices in the coconut oil market. The estimated price range of $1,900 to $2,050 per metric ton for coconut oil reflects a combination of constrained production and robust global demand, while palm kernel oil’s competitive positioning at $1,850 to $1,950 per metric ton underscores its role as a vital substitute. The market’s ability to balance these dynamics will depend on continued investments in sustainable production practices, advancements in agricultural resilience, and strategic collaboration among stakeholders across the value chain. These efforts will be critical in ensuring the coconut oil sector remains competitive and capable of meeting evolving global needs.

Source:

https://coconutcommunity.org/page-statistics/outlook